Start

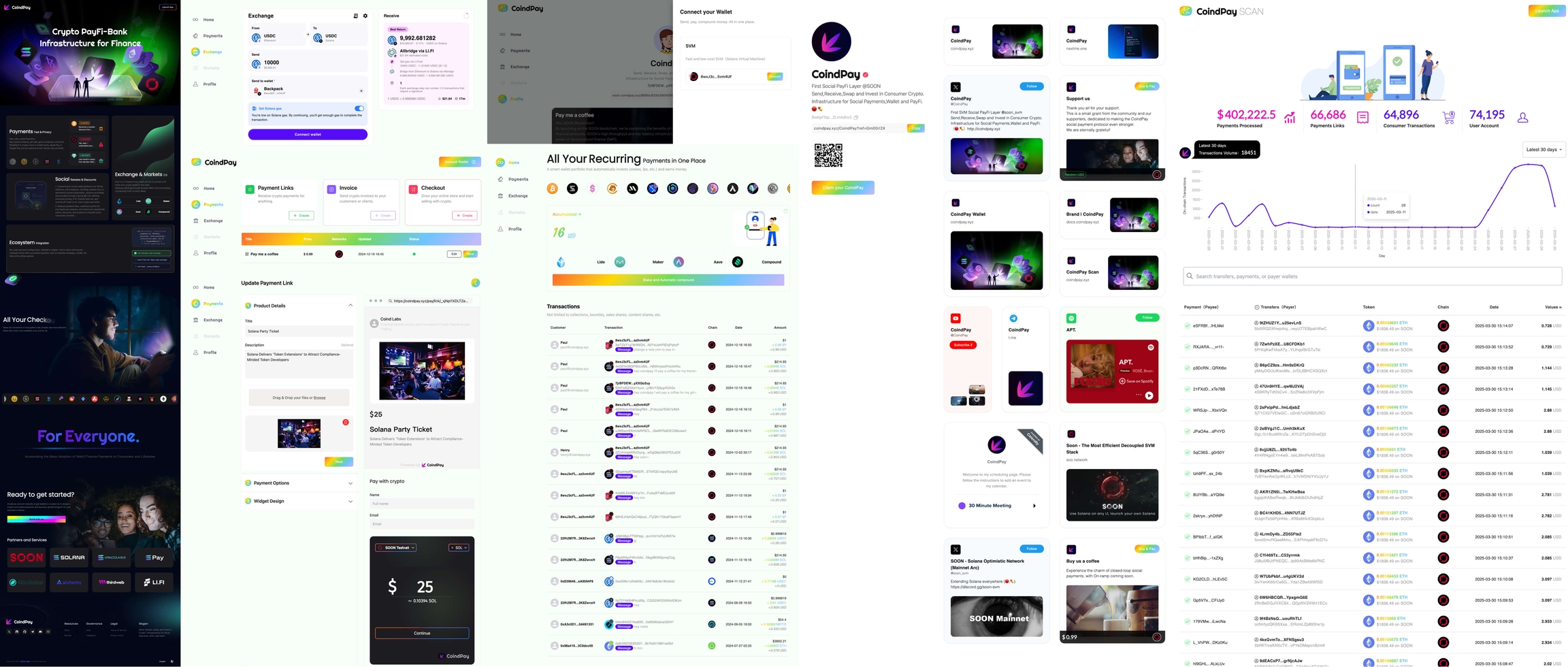

Pay, Buy, Sell, Swap, Earn — with Fiat or Crypto.

Infrastructure for Cross-border Payments、On/Off-Ramps and Real-time Settlements.

Overview

CoindPay is a compliance-first, cross-border payments and real-time settlements infrastructure designed for merchants, platforms, and creators. It connects traditional fiat payment rails with stablecoin-based settlement, allowing users to pay in local currencies through familiar payment methods while merchants receive funds in fiat or stablecoins — without needing to interact with blockchain complexity.

CoindPay delivers a Stripe-like payments experience (payment links, modular checkout flows, APIs, and widgets), combined with near real-time settlement—typically within 3–10 minutes, significantly faster than traditional T+N settlement cycles.

We operate strictly as a payments infrastructure and settlement layer. Blockchain and stablecoins are used only where they provide measurable advantages in settlement speed, capital efficiency, and cross-border operability. CoindPay does not engage in investment, speculative trading, token issuance, or consumer asset custody.

Mission

Accelerating the adoption of next-generation payments infrastructure for global businesses and consumers.

CoindPay focuses on making compliant, fast, and accessible fiat–crypto payments usable in real-world commerce, digital services, and global online businesses.

For creators. For brands. For platforms. For everyone.

Core Principles

Compliance-first architecture: Progressive KYC/AML based on transaction risk, volume, and jurisdiction

Unified fiat & crypto rails: One integration for cards, local payments, and stablecoin settlement

Real-time settlement: Faster access to funds compared to traditional banking rails

Non-custodial by design: Users and merchants retain control of their assets

Global scalability: Built for cross-border use cases from day one

What We Provide

CoindPay offers a modular and segmented set of capabilities, each supporting different aspects of merchant and creator payments. The structure follows a clear total–subpoint logic:

Payments & Global Settlements

Real-time global settlement layer for merchants and platforms

Accept fiat and crypto payments globally

Settle primarily in stablecoins with near real-time finality

Bypass traditional banking delays, funds accessible within minutes

Merchants and platforms requiring real-time cross-border settlements, supporting both fiat and crypto payments, with low-latency stablecoin settlement.

Wallet · Fiat ⇄ Crypto On/Off-Ramps

Unified on-ramp and off-ramp infrastructure connecting traditional payment methods with crypto rails

Buy, sell, and swap crypto using fiat or crypto

Compliant, risk-tiered onboarding and non-custodial settlement flows

Businesses needing compliant on-ramp/off-ramp flows, non-custodial settlement, and scalable cross-border crypto transactions.

Social Incomes · Links-in-Bio

No-code payment links and social distribution tools for creators, brands, and online businesses

Supports subscriptions, digital product sales, and bounties

Privacy-conscious and KYC-friendly payment experiences across fiat and on-chain rails

Creators, brands, and online businesses leveraging no-code links for subscriptions, digital product monetization, and social payments.

Ecosystem Integration

API-first and modular integration layer including payment links, embedded widgets, webhooks, and callback events

Designed to integrate seamlessly into existing products, workflows, and ecosystems

Enables scalable monetization and automated post-payment actions

Products and platforms seeking seamless API, widget, and webhook integrations for scalable payment workflows and automated post-payment actions.

Compliance & Risk Framework

CoindPay is built with a risk-tiered compliance model, designed to balance usability with regulatory obligations:

Progressive KYC/AML thresholds based on user behavior and transaction volume

Jurisdiction-aware onboarding rules

Transaction monitoring and partner-level risk controls

We work with regulated service providers and payment partners to ensure alignment with applicable compliance standards across regions.

Social Links

More information can be found on our social media.

Docs

All-in-one Social Portal

Last updated